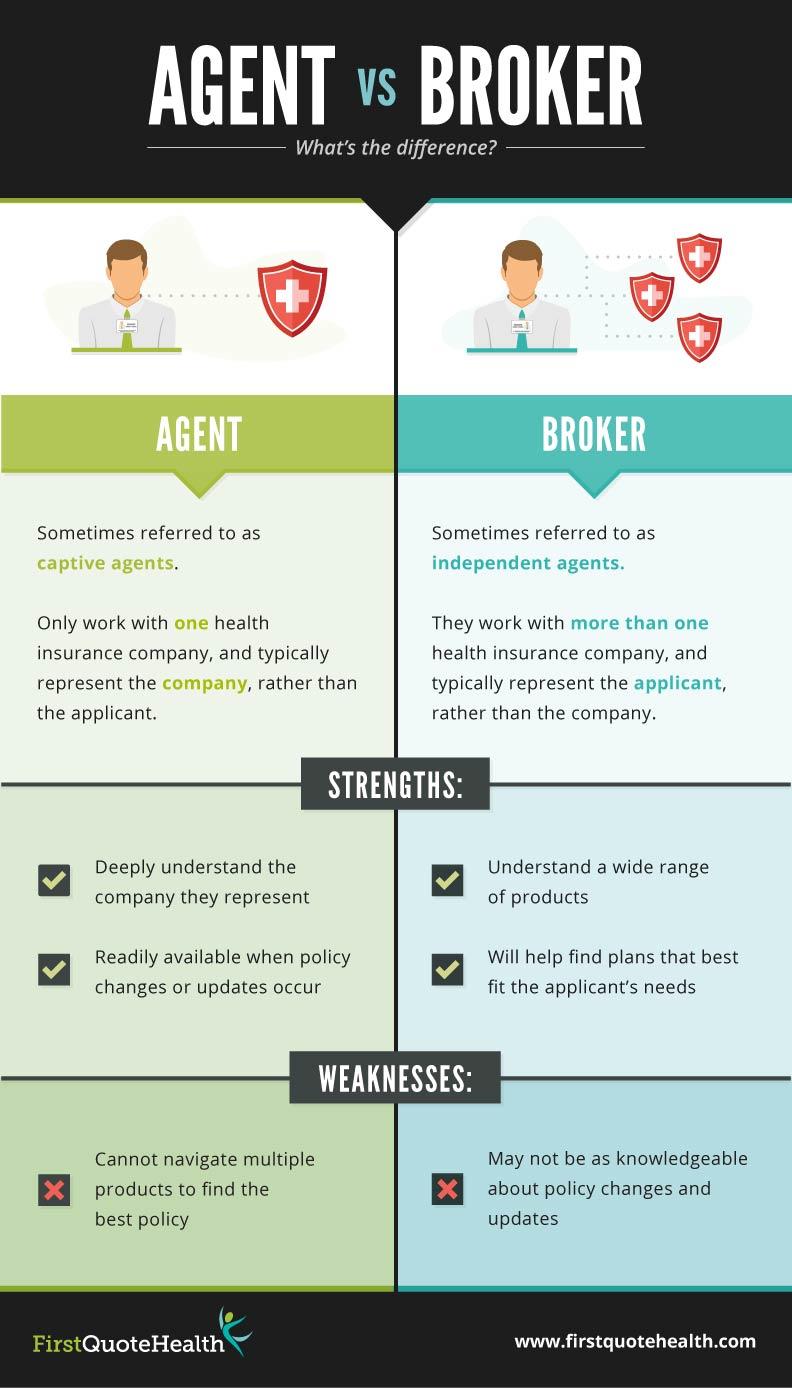

Insurance Agent vs Broker difference

A broker is an individual or firm that arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker is an agent who represents clients in a real estate transaction. They are licensed by the state in which they operate, and are paid a commission by the client or by the party that they are representing. An insurance agent is someone who sells insurance policies on behalf of an insurance company. Insurance agents are usually paid a commission by the insurance company for each policy that they sell.

Benefits of Insurance Agent vs Broker

There are a few key benefits of working with an insurance broker over an insurance agent.

First, insurance brokers are required by law to have your best interests in mind, while insurance agents are working for the insurance company and may have ulterior motives. Second, insurance brokers have access to a wider range of insurance products from different companies, while insurance agents usually only have access to the products from the company they work for.

Third, insurance brokers are usually independent and not beholden to any one company, while insurance agents are usually tied to one company. This gives brokers the ability to shop around for the best coverage and rates for their clients. And finally, insurance brokers can provide a higher level of customer service and will work with you over the long term, while insurance agents are often more transactional in their approach.

key roles of an insurance broker

Some key roles of an insurance broker include:

1. Providing expert advice on the type and level of insurance cover that a business or individual needs

2. Shopping around for the best insurance deals on behalf of their clients

3. Negotiating with insurers to get the most favourable terms for their clients

4. Providing on-going support and advice to clients in relation to their insurance cover.

key roles of an insurance agent

The main role of an insurance agent is to sell insurance policies to customers on behalf of an insurance company. Insurance agents typically work for a specific insurance company and sell that company’s products.

Insurance agents must be licensed in the states in which they sell insurance. To obtain a license, insurance agents must pass a written exam that tests their knowledge of insurance products and state insurance laws.

Insurance agents typically work in an office setting, but some may work from home. Insurance agents typically work regular business hours but may work evenings and weekends to meet with clients.

how does an insurance broker make a living

Most insurance brokers are independent contractors who work with multiple insurance companies. They receive commissions from the insurance companies that they work with and are paid based on their performance.

how does an insurance agent make a living

An insurance agent typically earns a commission from each policy that they sell.

Advantages of choosing an Insurance broker

There are a number of advantages of choosing an insurance broker over other options:

1. Insurance brokers are experts in the field of insurance and can provide impartial advice on the best insurance products for your needs.

2. Insurance brokers have access to a wide range of insurance products from different insurers, meaning that they can find the best deal for you.

3. Insurance brokers are regulated by the Financial Conduct Authority (FCA), meaning that they must adhere to strict rules and regulations.

4. Insurance brokers are required to act in your best interests, meaning that you can be confident that you are getting the best possible advice.

5. You can usually speak to an insurance broker over the phone or in person, meaning that you can get the advice that you need in a way that suits you.

Disadvantages of choosing an Insurance broker

There are a few potential disadvantages of using an insurance broker, which include:

1. You may not be able to get the best deal: While insurance brokers have access to a range of insurers, they may not have access to the very best deals. This is because some insurers work exclusively with specific brokers or don’t work with brokers at all.

2. You may have to pay a fee: Some insurance brokers charge a fee for their services. This fee may be a percentage of the premium you pay or a flat fee.

3. You may not get impartial advice: Insurance brokers are paid commissions by insurers for selling their products. This means that they may not give you impartial advice and may try to sell you an insurance policy from a particular insurer.

Types of Insurance Agents

There are two types of insurance agents: captive agents and independent agents. Captive agents are employed by a specific insurance company and can only sell that company’s products. Independent agents are not employed by any one company and can sell products from many different companies.

Captive Agents

Captive agents are insurance agents who work for a specific insurance company. They can only sell that company’s products. For example, if you go to a State Farm agent, they can only sell you State Farm insurance.

The advantage of using a captive agent is that they are very knowledgeable about their company’s products. They can answer all of your questions and help you choose the best policy for your needs.

The disadvantage of using a captive agent is that they may not be able to offer you the best deal. They are limited to the products of their company, so they may not be able to find you a cheaper policy from another company.

Independent Agents

Independent agents are insurance agents who are not employed by any one company. They can sell products from many different companies. For example, an independent agent may sell policies from State Farm, Allstate, and Progressive.

The advantage of using an independent agent is that they can find you the best deal. They are not limited to the products of one company, so they can shop around and find you a cheaper policy.

The disadvantage of using an independent agent is that they may not be as knowledgeable about the products of each company. They may not be able to answer all of your questions.

Advantages of choosing an insurance agent

There are many advantages of choosing an insurance agent over purchasing insurance directly from an insurance company.

Some of the advantages of using an insurance agent include:

1. An insurance agent can help you choose the right insurance policy for your needs.

2. An insurance agent can help you compare different insurance policies and find the best coverage and rates.

3. An insurance agent can help you file a claim and get the compensation you deserve.

4. An insurance agent can provide you with expert advice and guidance on all aspects of your insurance policy.

Where to find insurances agents

There is no definitive answer to this question as insurance agents can be found in a variety of places. Some insurance agents may work for a specific insurance company, while others may work independently. Some insurance agents may also be affiliated with a particular financial institution or other organization. You may be able to find an insurance agent by asking family and friends for recommendations, or by searching online directories.

Comments

Post a Comment

please be nice